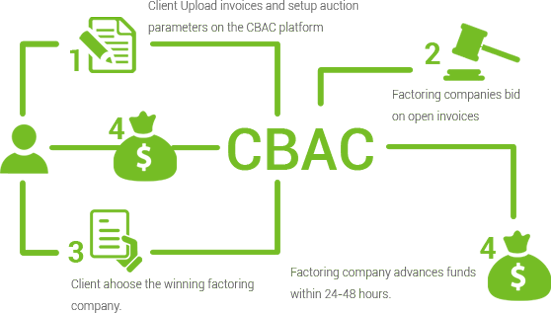

Take a look how it works in CBAC:

Benefits of Freight Bill Factoring

Using factors services provides you the access to the funds. It’s a much more convenient alternative comparing to applying for a loan all the time.

It’s a flexible financing option. Bank loans and credit cards limits you in various ways, while factoring is based on monthly amount of invoices.

LEARN 12 SECRET STEPS HOW TO MAKE $950 MORE PER TRUCK / MONTH

Hey! I'm George J.Magoci and I will send you a FREE eBook where you can learn 12 secret steps how to make $950 more truck/month.

Since the factors offer is determined by security of your customers paying habits, freight factoring is pushing you towards a good healthy business relations.

Other benefits of using freight factor:

- Covering the expenses on time

- Getting more loads much easier

- Expanding your customer base

- The initial advances are very high – more than 90%

- It works with fuel cards

- Growing your revenue

It’s not rare that small business don’t match the criteria when applying for a loan. In that case, factoring is the only option to deal with cash flow problems.

Also, one other important moment is the fact that freight factoring is not a loan, meaning that you are not diving into debt.

How Much Freight Factoring Costs?

After the filtering and making your list of optional factors, your aim is to pick one with the best terms. Keep in mind: the factoring rate is not equal to your costs.